See Bangla

Grameen America Hosts Third Annual Stakeholder Event Featuring Co-Chair and Grameen Bank Founder Professor Muhammad Yunus and President and CEO Andrea Jung.

Yunus Centre Press Release ( 2 April, 2023)

80+ funders, investors, and lenders joined Grameen America’s virtual stakeholder event on Wednesday, March 22, 2023, to partner on driving impact for low-income women entrepreneurs in financially underserved communities.

NEW YORK, NY, Date – Grameen America, the fastest-growing nonprofit microfinance organization in the United States, convened more than 80 community partners and supporters online with special guest Professor Muhammad Yunus, Co-Chair of Grameen America and Founder of Grameen Bank. Together, Grameen America and its stakeholders mobilized to leverage capital, research, and expertise to advance financial inclusion for women entrepreneurs of color.

Professor Muhammad Yunus founded the Grameen Bank in Bangladesh, pioneering the concept of providing small loans to women entrepreneurs living in poverty. In 2008, Professor Yunus brought the revolutionary microfinance program to the United States. Grameen America provides access to affordable loan capital, credit- and asset-building, and business training built around a proven group-lending model. Since 2008, Grameen America has disbursed over $3 billion to more than 167,000 women entrepreneurs across 25 U.S. cities.

The stakeholder event spotlighted a conversation between Professor Yunus and Andrea Jung, President and CEO of Grameen America on the future of microfinance and technology innovations for low-income women entrepreneurs. The event also featured a panel discussion with Grameen America leadership on upcoming strategic initiatives.

Key achievements and announcements at the event included:

- $3 billion in affordable business capital invested: At the start of 2023, Grameen America reached a record milestone of investing $3 billion in affordable business capital to women of color. The organization marked $1 billion invested in women entrepreneurs in 2018, $2 billion disbursed in 2021, and just a year and a half later, $3 billion. This record progress is a testament to Grameen America’s legacy as the fastest-growing microfinance organization in the U.S.

- Geographic expansion: Grameen America plans to build the organization’s national footprint in Riverside, CA, Phoenix, AZ, and Queens, NY in 2023.

- A bold 10-year vision: Grameen America is accelerating its bold vision for the future to empower 580,000 women entrepreneurs with $20 billion in life-changing business capital across 50 U.S. cities in the next 10 years.

- First-of-its-kind pilot national Savings Program: To support long-term asset-building, generational wealth, and positive money-saving habits, Grameen America is launching an innovative savings solution tailored to the specific needs of the low-income entrepreneurs it serves.

- New mobile application for members: Grameen America has created a mobile application for its members to take more action of their loan information, tools, and trainings on their own time while automating several branch responsibilities to allow Grameen America staff to prioritize relationship building.

- Connecting with Black businesswomen: In 2022, Grameen America’s Elevate initiative opened in Atlanta, GA to bring affordable business capital to Black entrepreneurs in the community and by 2030, aims to invest $1.3 billion in more than 80,000 Black women businessowners.

- Ambitious campaign to improve access to quality, affordable healthcare and education: The Grameen Promotoras program launched the $16 million Healthier Together Campaign to scale the program to more than 57,000 women in 15 locations over the next five years.

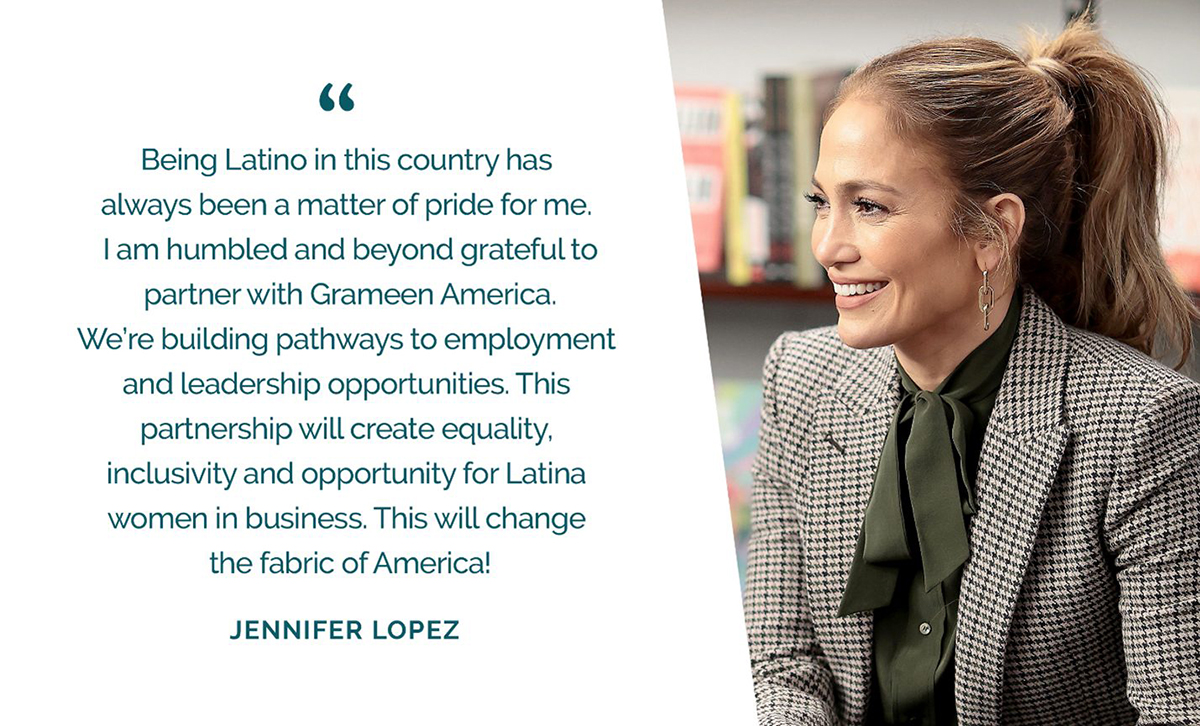

At the event, Grameen America previewed the release of its 2022 annual report: “Women are Limitless,” which features reflections on 2022, a letter from the organization’s National Ambassador Jennifer Lopez, member stories, and programmatic accomplishments and updates.

“It’s beyond imagination the scale that Grameen America has reached since 2008,” said Professor Muhammad Yunus, Co-Chair of Grameen America and Founder of Grameen Bank. “15 years ago, the idea of starting a microfinance program in the United States seemed like an impossible task. Congratulations to Grameen America for making the impossible, possible. With these impressive accomplishments, women have the capacity to transform their lives, their communities, and their nation.”

“Grameen America’s vision is to create an inclusive society where all entrepreneurs, regardless of gender, race, or income, have access to the fair and affordable capital they need – and it is truly a team effort. We wouldn’t have had the resources to accelerate scale and impact without the support of our incredible partners here today,” said Andrea Jung, President and CEO of Grameen America.

Caption for Photo 1: Nobel Laureate Professor Muhammad Yunus with Andrea Jung, CEO of Grameen America Inc. and Grameen America Inc. members during the board meeting events on March 22, 2023.

Caption for Photo 2: Nobel Laureate Professor Muhammad Yunus with GAI member during the GAI board meeting events on March 22, 2023

Caption for Photo 3: Musician and Actress Jennifer Lopez popularly known as J-Lo is Grameen America Inc’s National Ambassador to advocate for and mentor the organization’s network of over 150,000 small businesses run by women in predominantly low-income communities across the US.

###

About Grameen America

Founded by Nobel Peace Prize recipient Muhammad Yunus, Grameen America is a 501(c)(3) nonprofit microfinance organization dedicated to helping low-income women build small businesses to create better lives for their families. The organization offers microloans, financial education, and support to transform communities and fight poverty in the United States. Since opening in January 2008, Grameen America has invested over $3 billion in more than 167,000 women entrepreneurs. Opening originally in Jackson Heights, Queens, Grameen America has expanded to 25 cities in Atlanta, GA, Austin, TX, Boston, MA, Camden, NJ, Charlotte, NC, Chicago, IL, Connecticut, Dallas, TX, Fresno, CA, Houston, TX, Indianapolis, IN, Los Angeles, CA, Memphis, TN, Miami, FL, Newark, NJ, New York, NY, Omaha, NE, Oakland, CA, San Antonio, TX, San Jose, CA, Trenton, NJ and Union City, NJ.

End